Exporters of certain carbon intensive goods into the EU have new reporting obligations under the Carbon Border Adjustment Mechanism (CBAM). Based on the type of goods sold, UK and other non-EU businesses may be required to take additional action. So, what is CBAM, and what do qualifying exporters need to have in place to meet these new requirements?

Complying with the Carbon Border Adjustment Mechanism (CBAM)

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) was introduced by the EU in October 2023 and operated in a “transitional phase” until 1st January 2026, when it entered the “definitive phase”. Through CBAM, there are different requirements for qualifying EU importers and exporters of goods to the EU, which cover certain goods from UK businesses.

The overall objective of CBAM is to place a fair price on carbon emissions arising from the production of carbon intensive goods that are entering the EU. CBAM aims to ensure that the carbon price set on imports into the EU is equivalent to the carbon price set for domestic EU production.

CBAM initially applies to imports of items that are carbon intensive and at most significant risk of carbon leakage. These are:

- Cement

- Iron

- Steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

During the fully operational “definitive phase” (which applies to all EU member states), importers of in-scope goods will have to report on the greenhouse gases (GHGs) embedded in their imported products, also known as direct and indirect embedded emissions, as well as buying and surrendering the correct number of CBAM certificates. This means exporters of in-scope goods should expect any EU clients to request the direct and indirect embedded emissions associated with their products.

Note this only applies to any imports of electricity and hydrogen, and imports of over 50 tonnes per year of qualifying cement, iron, steel, aluminium, or fertiliser products.

What do UK Exporters Need to do?

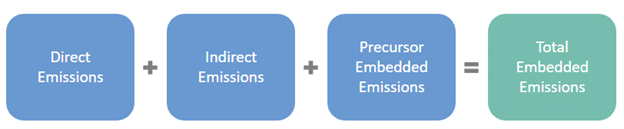

If you are a UK based exporter of any of the items listed by the EU, you will need to calculate the direct and indirect emissions of any qualifying products you export to the EU. Direct emissions are considered to be the emissions generated from the manufacturing of products, such as heating and cooling. Indirect emissions are those arising from the electricity used in manufacturing the products. Embedded emissions from any relevant precursor materials (key input materials) will also need to be considered. These are combined to calculate the embedded emissions associated with those products. All these results must be available in a CBAM Communication Report to provide to the importers.

In addition, exporters to the EU will need to develop a Monitoring Methodology Plan documenting how the embedded emissions have been calculated.

The exporter is obligated to report the relevant emissions to importers when requested and should have the information available in the expected format for the importer.

How Can We Help with Preparing for CBAM Compliance?

Circular Ecology can work with UK exporters to calculate the required emissions of the applicable products from CBAM relevant categories:

- Cement

- Iron

- Steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

This process involves working with the client to map out the relevant scope and boundaries and then supporting the collection of the required primary data to carry out the assessment. This process is similar in nature to a carbon footprint assessment.

Please use the form below if you would like to reach out to us regarding these services:

UK Government Releases Final UK Sustainability Reporting Standards (UK SRS)

The UK Government has published the long anticipated UK Sustainability Reporting Standards (UK SRS S1 [...]

Feb

Webinar Recap: Organisational Carbon Footprints: From Measurement to Meaningful Action

In February’s free webinar, Jon Burrow (Head of Carbon Accounting) and Joe Rouse (Senior Consultant) [...]

Feb

Upcoming Webinars: Carbon Datasets, Org Footprints, EPD Production

Circular Ecology are pleased to announce two upcoming free webinars, offering practical guidance on two [...]

Feb

EU Introduces First Voluntary Certification Rules for Permanent Carbon Removals

The EU has introduced the “world’s first” voluntary rules for certifying permanent carbon removals under [...]

Feb